There comes a point in every person’s life that they consider buying shares in a company. Whether it’s to make some money, invest for the future to experience the feeling of owning shares or even to ego brag (sorry guys you fall strongly into this category) you have just invested in a diverse portfolio or shares.

Really though your reasons should be one of medium to long term investment, or perhaps a pension fund (also known as a SIPP – Self Invested Personal Pension).

Can you really though just dip your toe in the water, spend say £100 and see what happens. Sure you can. In fact, you can start buying shares almost immediately, and with the range of brokers online, it’s usually something you can do in 10 minutes.

One of the biggest hurdles you need to climb is understanding the jargon. It’s more complicated than reading the launching instructions of a Russian rocket launch into space – in their Cyrillic language!

Fortunately, you can avoid all that right now. Grab a tea, a slice of cake (I find it’s always better to learn with tea and a slice of cake) and in this ultimate guide to buying and selling in shares we’re are ceremoniously going jargon free.

If I’m caught talking jargon that isn’t clearly explained, then I give you permission to take away my slice of cake. Be warned though, I’m very food territorial.

How do I open a stocks and shares account

When you’ve made a decision to invest in the stock market, and buy your own stock or portfolio of shares, you need to find a broker or trader. These are people that, for a small fee of course, will do all the work for you.

As an example, I myself just bought myself £100 of shares. I wanted to remind myself of the step by steps involved, and even I forgot how easy this is.

My account was set up and I had an order placed for £100 worth of shares in 7 minutes and 42 seconds. Yes, I even timed myself. From landing on the website, to having my order on record, it took less than 8 minutes.

Fast eh.

Fast though doesn’t mean easy money of course, but fast just gives me more time to do other things. Like having another slice of cake!

There are a lot of brokers out there, but I used Hargreaves Lansdown for my case study. I chose them through recommendations from reputable advisors, but you need to be comfortable with any broker you choose.

Hargreaves Lansdown have been in operation for almost 40 years, have 1.2 million clients and employ over 1,500 people. For me this was credibility enough for my £100 investment fund.

I didn’t open a Stocks and Shares ISA as I was just investing £100 here. If though you were going to invest larger sums of money a Stocks and Shares ISA means it’s free of tax up to £20,000 worth of investment.

If you make profit on shares not held in a Stocks and Shares ISA you need to pay tax on earnings as per the law. The law, I’m afraid, is law.

Here are the step by steps:

Open an Stocks and Shares Account

Just register for a simple Stocks and Shares Funded account. Upon registering you have three options:

- Pay a cash amount using debit card (minimum of £1);

- Pay a monthly direct debit amount (minimum of £25 per month);

- Pay a cash amount and an ongoing monthly amount by direct debit

I’m sure you’re not waiting on me to fill in the gaps here. The options are quite self-obvious, so no need for me to make this guide even longer with filler text!

You will need you National Insurance number, and you’ll need to enter basic personal information like name, address and telephone number, but once the amount has been loaded in to your account, you are good to go!

How do I buy stocks and shares

This really shouldn’t be one of the first questions you ask yourself, but I’m assuming you have already asked yourself – and have an answer – for the question you should have asked yourself, which is ‘which shares do I invest my hard earned money in’.

Now of course we at Money Boost are many things, but we are not financial advisors, and nor do we claim to be. This I’m afraid you must do for yourself. We can show you some of the places to look but not what to buy. This must be a personal decision and for this it’s always best to seek out independent financial advice.

There are great online resources including Government guidelines, plus you may want to check out ADVFN which has long been considered to be a fountain of knowledge on stats, numbers, news and up to the minute share prices.

On sites like these though it’s easy to become Alice and get down the internet rabbit hole, but don’t get too sold on bulletin board tips. Stay unemotional and stick to your goal.

Once though you have made your decision on which shares to buy in to, trading couldn’t be more simple:

Search for a Company and Stock

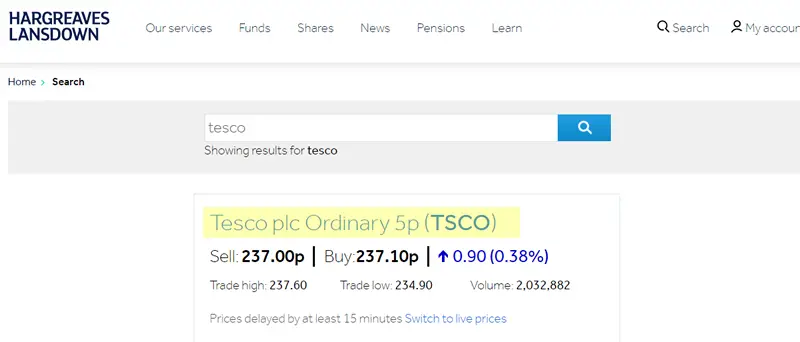

Simply press the Search button beside the magnifying glass and search for either the name of the company you wish to invest in to, or the short name for the company (e.g. GOOG = Google)

See the Buy and Sell Price and Choose Company

In this example I searched for Tesco. The ‘Sell’ price is how much you could sell this stock for right now, and the Buy price is how much you can purchase this stock for right now. As you will see the Buy price is usually always higher than the sell price, for obvious reasons. So, currently I can purchase this stock for just over £2.37 a share. On this screen you would select the Tesco plc company name, highlighted in yellow in the screenshot below

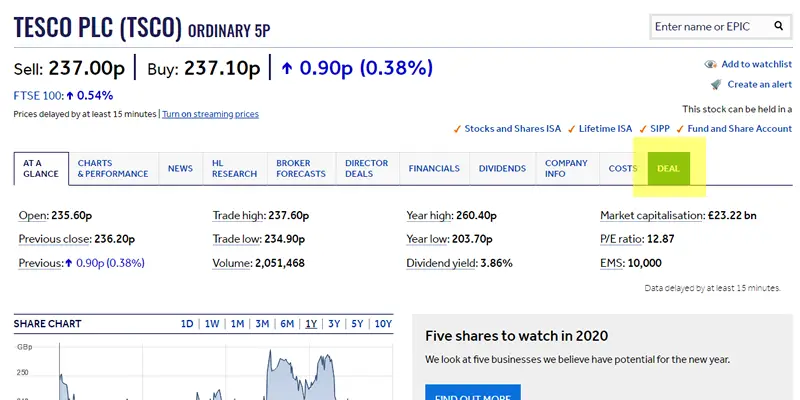

Understanding the stocks and shares information

You may feel a little overwhelmed on this screen. It can feel like sitting in front of the controls of a jumbo jet, and being told you are the only one that can fly the plane. Once you gain a grasp of the information, it’s really not that bad

- Sell = the price, per share, you can sell you shares for;

- Buy = the price, per share, you can buy shares in this company for;

- Open = this is the share price the stock opened for when markets began trading this morning;

- Previous Close = this is the share price the stock closed at last night (or Friday night if you are looking at these results on the weekend or Monday morning);

- Market Capitalisation = is the total market value of a company’s stocks and shares. So it gives an idea of the value invested and the size of the company;

- P/E Ratio = stands for ‘Price to Earnings Ratio’. Investors use this as a metric as to whether to invest. It means how much an investor is will to buy as a stock price in relation to a company’s profits or earnings. If a company reported earnings per share were £3, but the share price is trading at £12 – it means the PE Ratio is 4;

If you want to go ahead and make a purchase, you will need to click on the ‘Deal’ button as highlighted in yellow

Buy Your First Shares

As you can see you are now ready to go. The current price is to buy your share is 236.60p or £2.366 per share. Some things to note

- The Buy option should be selected;

- The Quantity box should either be a quantity of shares you wish to buy (e.g. 50) or a total value of shares you are buying (100 – if you want to buy £100 worth of shares)

- The Quantity Type you should choose either Pounds Sterling or Number of Shares – depending on the value you entered in the Quantity field

- Once you select the ‘Quantity Type’ you will have the option to include the charges and fees in to your price. If for example you chose £100 Pounds Sterling, you can either include the £11.99 trade fee to the order (meaning you are buying £88.01 worth of Tesco shares) or if you leave the box unticked you are buying £100 of Tesco shares, but will need to pay the £11.99 on top, meaning the total price you pay is £111.99

Once you are ready you can press the ‘Place a Deal’ button, and this will send an instruction to the trader to buy the stock. This happens in real time if you are inside trading hours.

Your the Proud Owner of Stocks and Shares!

Congratulations, you have bought your first share holding!

This was the result of the £100 I invested (which included the £11.99 fee – so in reality I invested £88.01). In this example I have managed to make a small 17p profit already, as you’ll see in the ‘Gains/Loss’ column.

It’s worth noting it will cost another £11.99 to sell your shares.

You don’t have to worry about paper shares any longer. In the digital age your shares will be held in your online account, ready for you to purchase more shares or when you are ready to sell.

Just remember you have to pay the trade fee every time you purchase and every time you sell. At the moment the cost to do this with Hargreaves Lansdown is £11.99 per trade (or £23.98 for the purchase and then sale of the shares purchased).

It’s all too often to forget these fees when buying and selling shares. What looks like a nice small profit can be eaten up by fees.

For example, the £100 trade I did today I have to pay £23.98 to buy and then later sell the stock. This means the share price needs to increase by 23% for me to even break even.

As this fee is fixed it means the more you invest, the less the share price has to increase for you to make a profit.

If I had invested £1,000 instead of £100 – and my total fees are still £23.98 to buy and sell the shares – it means the share price has to only increase by 2.3% in order for me to break even.

One last thing to note is that difference between the Buy and Sell price (or Bid and Offer as it’s also known as in other financial publications such as ADVFN). When calculating your return make sure you use the Buy (or Bid) price to work out your profit.

In Conclusion

If you have reached this far, well done. You’re a serious researcher. Research is the key to everything, and what takes speculation and gamble in to a more refined and analytical judgement.

When you see the investors on Dragon’s Den, they take a punt and decide to go with businesses that they feel will grow. You will see the grilling would be entrepreneurs get

The often very nervous pitcher isn’t given a one-way path to riches. They are given a grilling worthy of the FBI. The Dragon’s will prod and poke at the very nerves the entrepreneur is trying to deflect.

They take little nonsense and even less crap. If an entrepreneur doesn’t know his financials, know where the business is going and how to get there or puts a wildly over-estimated and over-inflated price on their business, they’ll met by some fierce and fiery ‘I’m Out’s!’

You have to research like a dragon. Don’t be fooled by hype or sales pitches.

Whether you choose to take a managed portfolio through a bank such as Barclays or Santander, or decide to trade yourself, if you are going to make a sizeable investment it’s definitely worth looking into a Stocks and Shares ISA.

A Stocks and Shares ISA will allow you to invest up to £20,000 per year tax free. This means no tax will be paid on any profit made from your £20,000 investment like it would do if you invested in shares outside your Stocks and Shares ISA.

You may find our How You Could Invest £100 in the UK in 2020 feature helpful, with some useful links into the Stocks and Shares ISA.

Disclaimer: Money Boost do not provide financial advice and the information is just that, it should be used for entertainment basis or additional information as part of a much wider research. We advise you to seek our independent financial advice from an independent financial advisor before investing any money. Remember many investments lose money. Your money is at risk every time you invest.