Wealthify is the relatively new investment company owed by the Aviva Group.

It allows its customers to invest in a range of investment options and help them save towards retirement, for general investing or an adult or junior ISA.

Considering it has the backing of one of the largest insurance and investment companies, we know it is safe company to use, but is it worth it?

Money Boost has put Wealthify through its paces.

Over the past 8 months (as of Summer 2021) we have registered, invested, and contributed on a monthly basis into an investment ISA, using the managed stocks and shares as the investment option.

What Return Can Be Made by Investing with Wealthify

Over the past 8 months we have personally seen a 2.97% return on an initial investment using Wealthify.

Considering the standard UK Banks are offering returns as low as 0.1% interest per annum, this is considerable increase.

An investment of £1,000 in a UK bank would see a return of £1 over a year.

If all things remained equal, a £1,000 investment through Wealthify would see returns of £29.70.

Nearly 30 times a much!

It is worth noting though, before we get too carried away, that for the first few months we saw a negative return, meaning our investment was worth less than we had put in.

This is the real risk with any investment fund, particular a stocks and shares ISA.

The volatility in the stock market due to the Covid-19 pandemic almost certainly a contributing factor, but of course such troublesome patches in the market can happen at any time.

Is Wealthify Easy to Use

The one thing we like about using Wealthify is the app.

It’s straight forward an intuitive to use. Through our Android device it recognises finger-print log on and takes you to your Dashboard showing your investment value plus return % and total growth shown as a decimal.

To be honest other than this the app hasn’t served much other purpose for us.

You can though top up your investment value, as well as read through the latest Wealthify news articles which are updated at a rate of one or two articles per week (if that sort of thing is of interest to you) and it also allows you to contact Wealthify and check out your Rewards.

Rewards are a way of earning cashback through Wealthify when shopping online through a number of connected shopping partners, but we will cover this a little later in this article.

You can of course access your Wealthify account online using a PC or laptop if you prefer not to keep such sensitive apps and material on your mobile device.

A tablet can also be used to check and manage your investment.

We would certainly give the app and overall user experience and good 9 out of 10 to use.

How Wealthify Works

Open an Account with Wealthify

To get started you need to open an account with Wealthify.

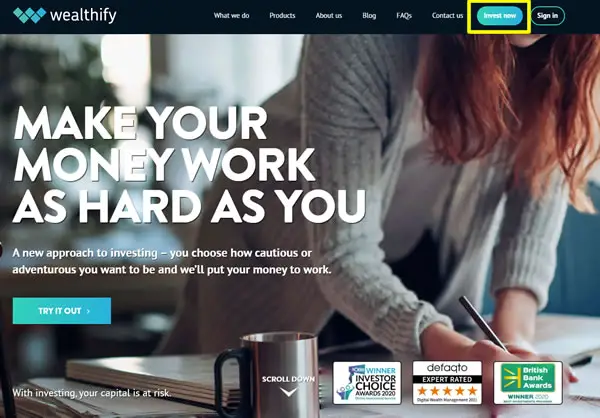

The easiest way to do this is to visit the Wealthify website and choose the ‘Invest Now’ button in to the top menu, as shown in the screenshot below:

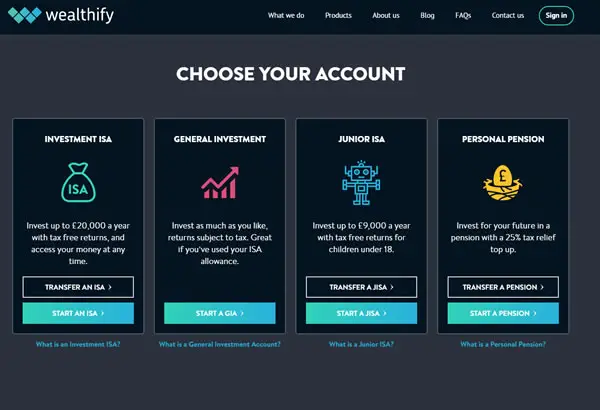

From here you need to choose the type of investment you wish to make from one of the following options:

- Investment ISA

- General Investment

- Junior ISA

- Personal Pension

Investment ISA

An Investment ISA is essentially investing your money in stocks and shares.

An ISA (Individual Savings Account) is a tax free way to invest up to £20,000 per year and not pay tax on any revenue your investment returns – see the latest Gov UK ISA rules for 2021 and 2022.

Fortunately, there is no minimum amount needed. You can start with something small and steadily increase.

It’s amazing how small amounts can add up!

Another big plus is there are no withdrawal time constraints or fees for taking back your cash. If you need to gain access to your money at any point simply withdraw your money back to your bank account.

General Investment

General investments are very similar to ISA stocks and shares investing but there is no maximum amount you can invest.

You will though need to pay tax on any returns made through your investment.

A general investment plan is a good option for those who wish to invest much larger sums than an ISA allows, or if you have already used your full £20,000 ISA allowance.

Junior ISA

A Junior ISA is a great way to encourage children to start saving from an early age.

It’s also a great way to save for a child’s future. You can save up to £9,000 a year, tax free, within a Junior ISA account.

The account will be in the name of your child, or the child you are investing for, and they will be able to access their account and money once they reach the age of 18.

Personal Pension

This is the option for those who wish to create a self-invested personal pension plan (also known as SIPP).

You can invest up to £40,000 per year.

Choose Your Investment Values and Investment Type

In this example we will look at the Investment ISA option.

The next tool is a really handy way to see what potential returns you could make.

You have a few options here depending on the amounts you wish to invest, risk you’re prepared to take and how ethical you would like your investments to be.

In this example a £1,000 initial investment, with £200 monthly contribution using a Confident investment style and Ethical investment theme could see a return of between £23,740 to £34,450 – with a potential average return of £28,641 after 10 years.

Initial Investment

This is the amount you would like to immediately pay into your ISA account.

Monthly Investment

The continuing monthly amounts you would like to pay into your ISA account

Investment Style

Here you can choose how risky you would like your investment to be.

If you would like to put your money in to slow growing, but safe stocks and shares, then the Cautious and Tentative options may be applicable.

If on the other hand you are happy to increase the risk on your investment, on an assumption you plan may end up with less money than you put in, then the Ambitious and Adventurous options may suit better. This will see your money invested in risky, perhaps start-up companies, that could exceed expectations and provide a nice return.

For most of us, we like to sit squarely in the middle. Not too risky, but not too safe and would like to mix the risk for a potentially higher return. The Confident option is a great choice for those people.

Investment Theme

Wealthify give you the option to invest in any company on the indexes they feel would provide the best return, or for the more ethically minded just into environment and social aware companies.

The Ethical option provides a slightly lower estimated return by around 3% of total value.

How Wealthify Invest Your Money

Based on the Wealthify website, and – for example, the Wealthify Confident Ethical Investment PDF guide – will give you a really good idea where your money will be invested.

The Ethical theme investment is much different to the Standard.

The Standard theme will see your money invested globally across bonds, property shares etc… around the world and provide a mix of relatively safe to more risky holdings. The investment is shared mainly between the UK at 28% and the U.S. at 28% with other global countries making up the remainder.

The Ethical vetted theme appears to concentrate again on bonds, property, shares etc… but the majority of investment appears to stay within UK and Europe. 47% stays specifically in the UK with 28% being termed Global and 10% within the US.

The safer plans, such as the Ethical Cautious plan invests 62% of your funds in the UK, 22% in the U.S. and the remaining 16% across the rest of the world.

Frequently Asked Questions

Who owns Wealthify?

Wealthify is owned by the Aviva Group. One of the largest insurances and investment groups in the world.

Is Wealthify Safe?

Wealthify is safe. As it is owned and backed by the large Aviva group, it is as safe an investment company as you are likely to find. All investment comes with risk of course.

What are the Wealthify Fees?

Wealthify charge an annual 0.6% fee. This means you will pay approx.. £6-£7 a year with a £1,000 investment.

It is worth noting that Ethical plans have a higher annual fee of around 1%. This means a £1,000 investment be charged on average £10 a year in fees.

All fees are taken monthly and automatically from your investment fund account.

In Conclusion – Wealthify Review

If you are considering an investment plan, and in particular a stocks and shares ISA, it is certainly worth exploring the Wealthify option.

Our own experiences, once we were set up, have been positive.

In the early days (through the height of Covid-19 I may add) we did see negative returns on our investment. This though can be expected.

With a 2.97% return so far across 8 months, which is higher than almost all UK bank and savings accounts at present, we are so far pleased with the results.

We will keep this post updated as our investment plan continues to grow.